Founded for the financial strength of the community, Pioneer has been operating within New York's Greater Capital Region for 135 years, providing financial support to help people build a better life. Today, our values remain the same, holding firm to our belief that our customers, our employees, and our community come first.

Throughout this time, Pioneer has adapted our services while remaining a competitive and financially sound organization:

- From a single office open one evening a week, to 22 branch locations and the construction of our new state-of-the-art Headquarters at the gateway of Tech Valley;

- From our founding years when anyone could purchase a “share” in the savings association for the purpose of becoming a member and earning the privilege of borrowing capital, to today when Pioneer Bancorp, Inc. is publicly traded on the NASDAQ;

- From supporting thousands of community efforts over the decades, to the establishment of the Pioneer Bank Charitable Foundation committed to “helping kids be kids”.

Pioneer has always strived to expand our capabilities and reach to serve a larger community and create more jobs and opportunities for our neighbors.

Understanding the need to work together to lift each other higher, to surround customers with the products and services they need to be successful, and to continue to expand offerings to better fit the needs of our community, Pioneer began diversifying its services in 2016 to include Insurance, Wealth Management, and Employee Benefits, in addition to Banking.

Pioneer isn't just another financial institution. It’s a group of local leaders and neighbors who actively pursue and promote the well-being of our communities. Our promise is to inspire progress one individual, one family, one business, and one community at a time.

We're Pioneer, and we're moving All Together ForwardTM.

Milestones in Pioneer's History:

1889: A group of printers employed by a local newspaper, the Troy Daily Press, consulted with their employer, Henry O'Reilly Tucker, about the possibility of establishing a building loan and savings association to encourage the practice of saving. On March 7, 1889, the Pioneer Building Loan and Savings Association of Troy was incorporated. Five days later, on March 12, 1889, Pioneer opened for business. The premise was simple: anyone could become a member of the Association by completing applications on any Tuesday evening and paying an initiation fee of 50¢. Members could then invest in "shares," and allowed the privilege of borrowing for the purpose of purchasing real estate. The first loan was actually made one week after the Association was opened, for $2000.00 to a man named Knauffman, at 5% interest with a 3¢ premium per share.

1914: Pioneer expands hours of operation from one evening a week to Monday and Tuesday evenings.

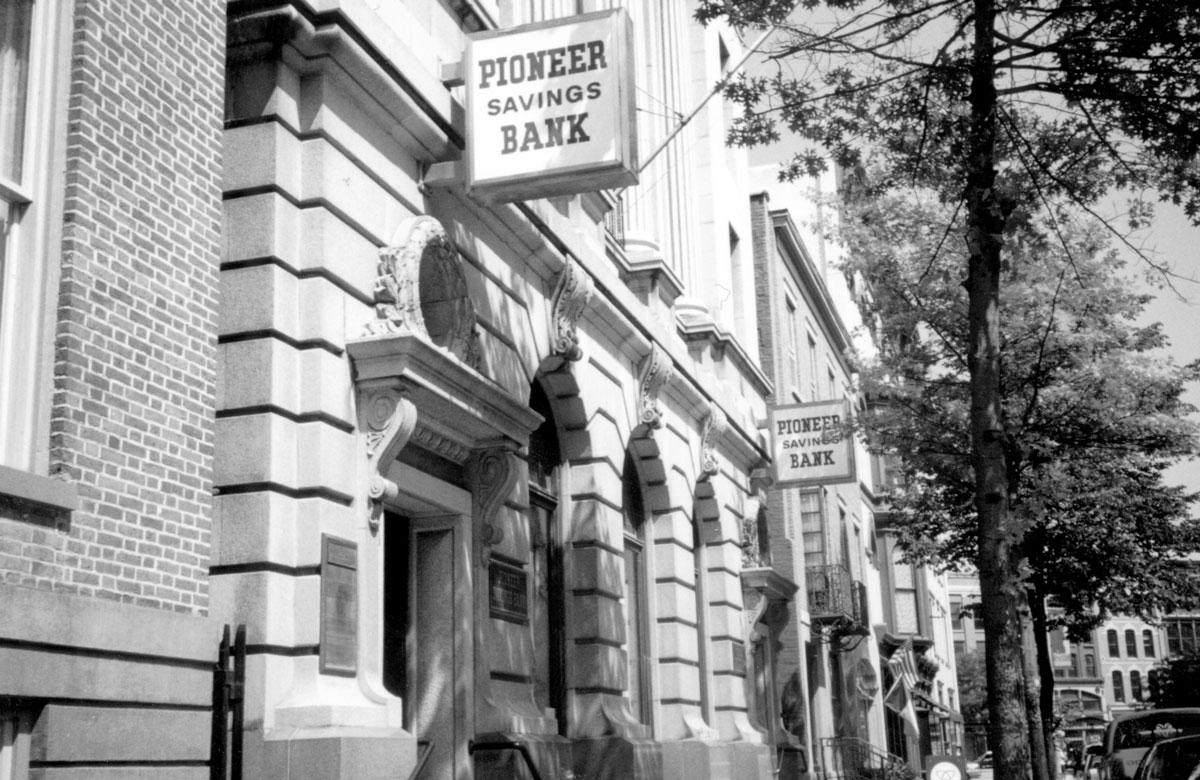

1915: After 27 years of leasing business space, Pioneer purchased its own building at 30 Second Street from R.P.I. for $11,000.00.

1950: Pioneer moved their Main Office a few doors down to 21 Second Street. Pioneer purchased the building from the Niagara Mohawk Power Corporation; a building originally constructed in 1914 for the Troy Gas Company.

1953: Installation of a sophisticated (for its time) IBM data processing system.

1958: Pioneer opened a second office in Latham on June 2nd, 1958.

1972: Conversion from a savings and loan association to a savings bank.

Watervliet office opened; SBLI Department opened.

1976: Installation of first online computer terminals, linking the bank to an off-site shared service center. Transactions were posted live and the effects of deposits, withdrawals, holds and payments were instantaneous on customer account balances.

1976: Pioneer introduced to its customers the precursor of today's checking and NOW accounts - the Payment Order Account. With this product, our original Checking Department area was created.

1981: Consumer lending powers were granted to savings banks in New York State.

1987: Introduction of the home equity loan.

1997: PSB Financial Services Inc. was formed.

1999: Installation of a new computer network and processing system to ensure our ability to effectively compete in the 21st century. Debit cards were offered for the first time to checking account customers.

Wynantskill office opened.

2000: PSBFSI began offering a variety of other investment products by obtaining approval to sell mutual funds and securities.

Brunswick office opened.

2003: Addition of online banking, overdraft protection and commercial lending products.

Colonie office opened.

2004: East Greenbush office and Green Island office opened.

2008: Pioneer Savings Bank assumed the name of Pioneer Bank, a full service bank serving individuals and businesses in the Capital Region.

2009: Pioneer Bank began using a "Proof of Deposit" (POD) technology to streamline check processing and improve processes.

2010:

Delmar office opened despite the country enduring a recession.

2013:

Clifton Park East office opened with a unique layout unlike any other bank. The branch includes a retail shop, digital picture printer, copy center and coin counter. This location is Pioneer's first USPS approved shipper branch.

Albany office is relocated to 90 State Street with a modern layout.

2016: Pioneer begins to grow rapidly. A partnership with Homestead Funding Corp. allows Pioneer to offer a wider range of mortgage products to homebuyers. Pioneer acquires Anchor Agency, Inc., a Capital Region based insurance agency, giving Pioneer the ability to offer a comprehensive line of

insurance products to its commercial and retail customers. Pioneer also expands its footprint into Greene County with the acquisition of bank branches in Cairo and Greenville. Pioneer moves to its new state-of-the-art Headquarters in Colonie, NY. The building was constructed specifically for Pioneer Bank and includes retail space for businesses to lease as well as the

Wolf Road office.

2017: Keeping busy, Pioneer opened offices in Cohoes and

Queensbury, remodeled the Watervliet office, and relocated the East Greenbush office to Greenbush Commons. In the process, added 3 more ITMs, acquired an Employee Benefits division (Pioneer Benefits Consulting), launched a new website, introduced new retail eBanking and checking products, as well as added increased benefits to Pioneer Perks. Pioneer Bank was also named Albany Business Review's Best Places to Work for the 5th year in a row!

2018:

Brunswick and

Wynantskill offices remodeled. Pioneer launches the

Pioneer Bank Foundation committed to "helping kids be kids" and it held its first signature event –

the Grand Carnival. Pioneer was also named Albany Business Review's Best Places to Work for the 6th year in a row and Pioneer's headquarters, Pioneer Plaza, received the Building of the Year award from the Capital Region Building Owners and Managers Association (CRBOMA).

2019: In addition to remodeling our

Malta office, Pioneer also acquires Ward Financial Management, doubling the amount of brokerage and advisory assets the advisors of

Pioneer Wealth Management serve collectively through LPL Financial. Pioneer was also named by the Albany Business Review as a Best Places to Work for the 7th year in a row, as well as a Healthiest Employer.

Pioneer Bancorp, Inc. (PBFS) is publicly listed on the Nasdaq on July 18.

2020: Pioneer completes construction of a new

Colonie office, the first new construction branch since 2016. More than 1,000 Paycheck Protection Program loans are processed through the Small Business Administration on behalf of Pioneer customers, enabling continued operations and staffing throughout the pandemic. Pioneer also launches a new brand strategy and identity,

All Together Forward, around the concept of being "more than a bank" by offering a complete set of financial services to help each customer achieve success. Pioneer is named a Best Places to Work for the 8th year in a row, and a Healthiest Employer for a 2nd year.

2021: Pioneer is named a Best Places to Work for the 9th year in a row, and a Healthiest Employer for a 3rd year. The Pioneer Charitable Foundation hosted a successful School Supply Drive, with donations benefitting the Rensselaer Department of Youth, and also surpassed $1 million in donations to local non-profit organizations and 10,000 hours of employee volunteer hours since its inception in 2018.

2022: Eclipsing $2 billion in assets during the year, Pioneer also launched a dedicated SBA lending program to assist small businesses. The organization continued its streak of being named a Best Places to Work for the 10th year in a row, and a Healthiest Employer for a 4th year. The Pioneer Charitable Foundation also hosted its first All Together Forward Day that included employee donations to Ukrainian relief efforts, a school supply drive, and volunteering throughout the Capital Region. The Foundation also provided $2,500 grants to six local non-profits during its first Pioneers with Purpose grant program, funded entirely by employee contributions.

2023: Pioneer expanded its Wealth Management division and exceeded $1 billion in assets under management with the acquisition of Hudson Financial in Hudson, NY. Across the river in Greene County, Pioneer also invested in improvements at its Cairo and Greenville branches. The Albany Business Review named Pioneer a Best Places to Work for an 11th successive year. The Pioneer Charitable Foundation marked its fifth anniversary by surpassing $1.6 million in donations to more than 400 local charitable organizations.

2024: Pioneer's banking division became chartered through the Office of the Comptroller of the Currency (OCC) under the name Pioneer Bank, National Association. In addition, Pioneer's insurance division also changed names to become Pioneer Insurance Agency, Inc., to better align with our branding. The Albany Business Review named Pioneer a Best Places to Work for a 12th consecutive year. Nasdaq hosted Pioneer leadership on July 16th to ring the closing bell in commemoration of the company's fifth listing anniversary. Pioneer also launched Express Small Business Lending, providing small business with access to critical funding within a few short business days, and Smart Start Banking, a checking account exclusively for teens and young adults.